Casual Tips About How To Prevent Accounting Fraud

The person who creates the invoices should not be the one applying.

How to prevent accounting fraud. To prevent and detect accounting fraud: Most ar fraudsters use the same tactics to hide their. The key to real accounting reform is to remove the economic incentive for accountants to be halfhearted in their audits.

Develop a fraud risk policy & response plan. To facilitate prevention and detection of accounting fraud in the future , there is a need to intensify m onitoring of companies’ financial books once results are posted. Generally, your safest move is to keep the suspect employee from touching or removing anything, besides personal items, from their work area.

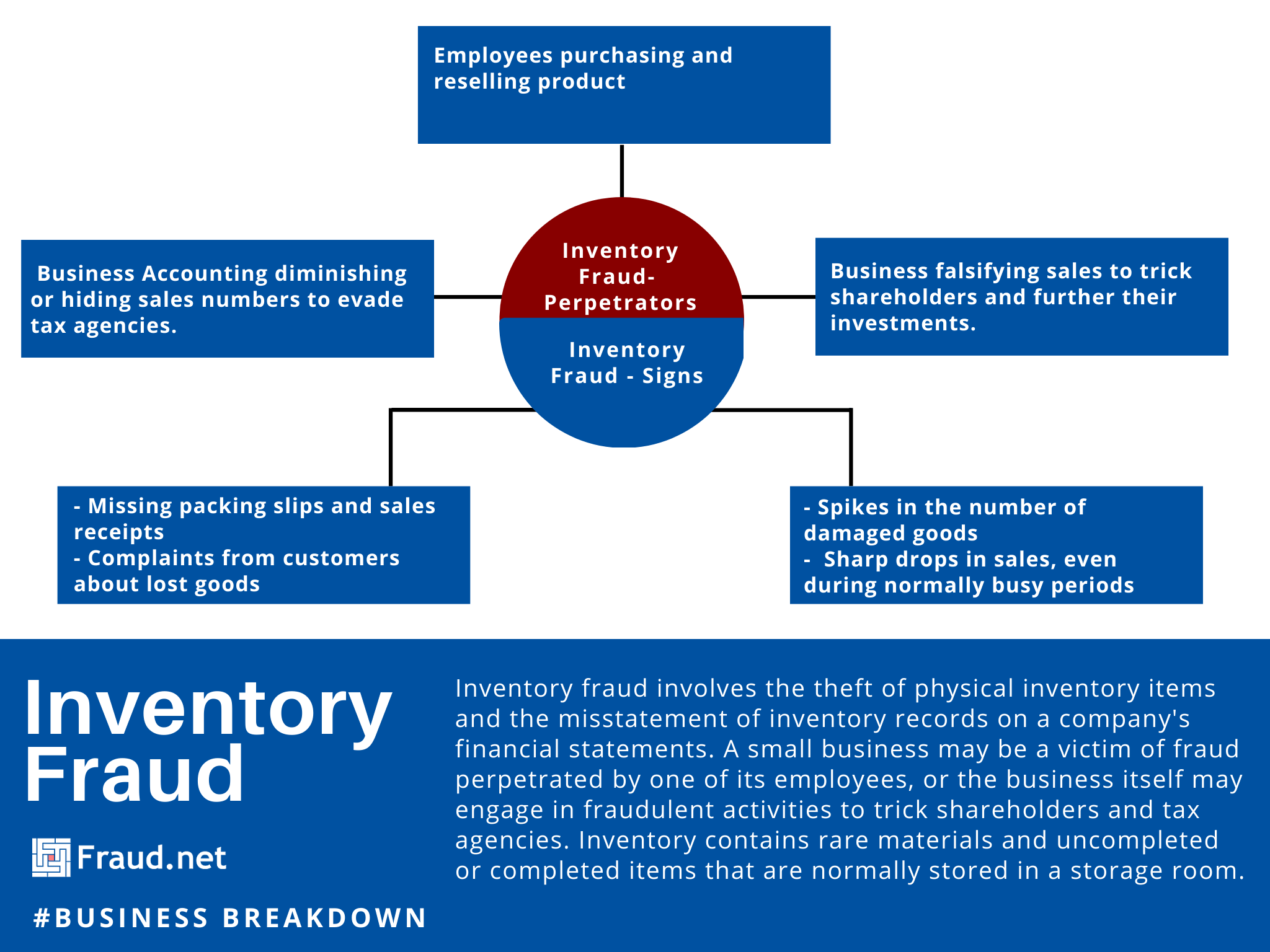

By assigning more than one staff member or employee to handle the processing and accounting for cash from beginning to end, organizations can lessen the opportunity for. The pareto principle can be successfully applied to identify and prevent the most common cases of accounting fraud. Automating your billing can not only reduce the possibility of fraud but also saves time and money.

The good news is that you can detect and avoid account payable fraud and even stop it from occurring if you know what to look for and where to look. Streamlining your business process with ap automation makes your. Separate the functions of account setup and approval.

Running ap on spreadsheets, email and calendar apps does little to mitigate, identify or correct fraud. One way would be to make the audit of public. Hiring employees who will have access to sensitive information should.

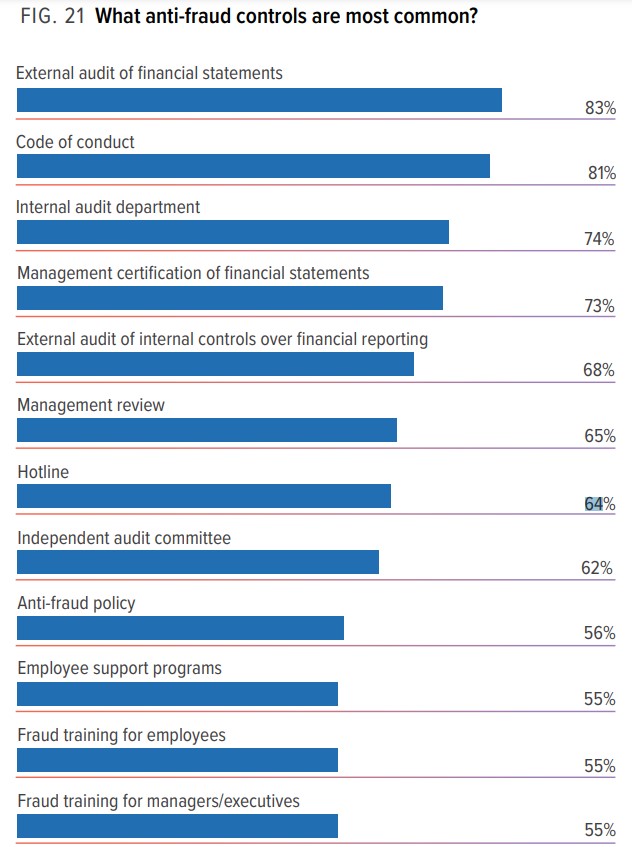

Know your employees segregate accounting functions make employees aware of. Don’t wait until fraud happens to address it. This webinar will explain how to quickly identify the top 20% of control.

/Internal-controls-4194435-FINAL-81238b6f63dd44e5a87d9169d4d02994.png)