Outstanding Tips About How To Fight Credit Cards

Your credit card company will start the lawsuit by filing a complaint in court.

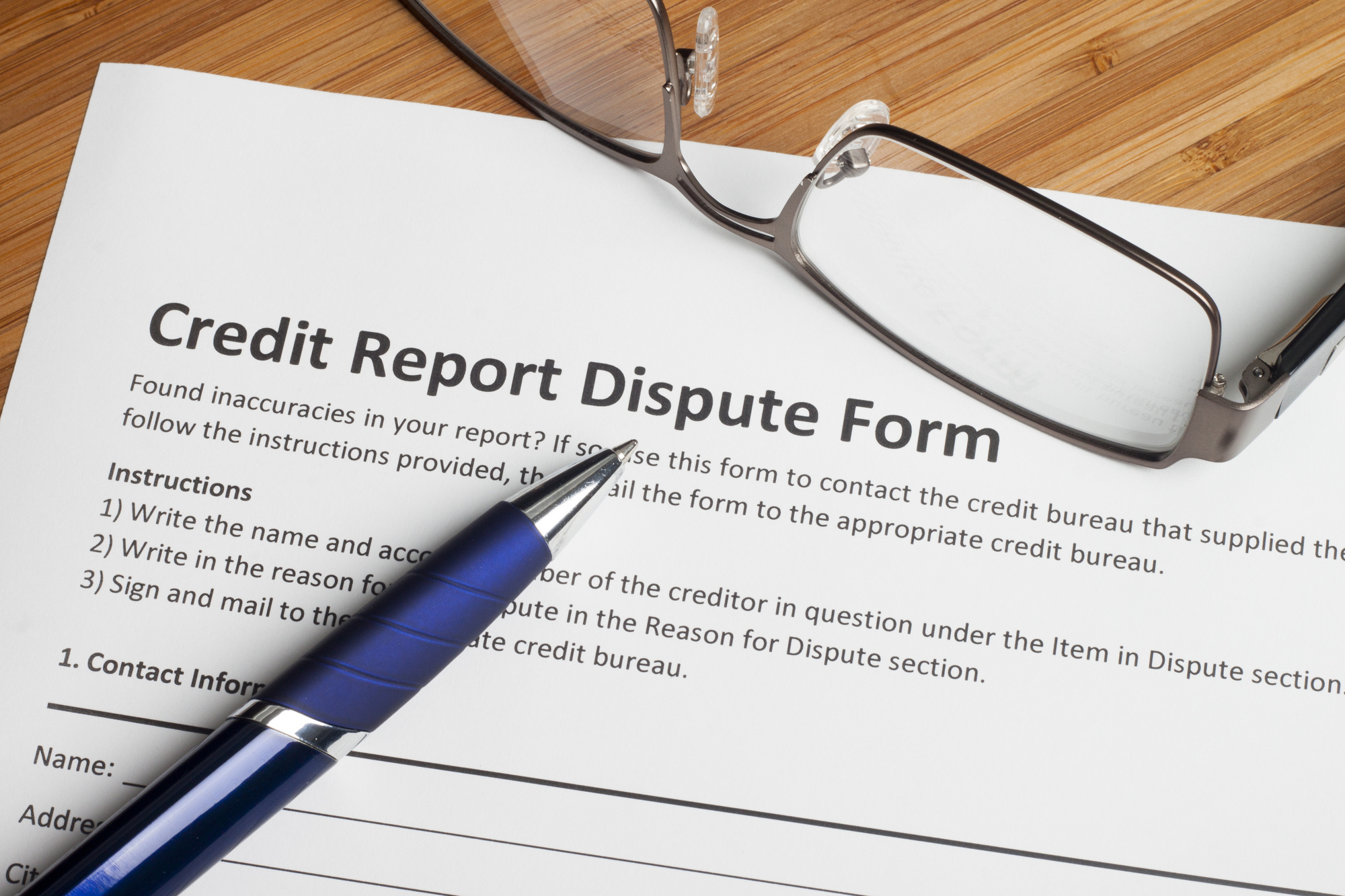

How to fight credit cards. Avoid interest charges by paying your statement balances in full. You’re required to respond to the lawsuit. Proof of assignment. this demonstrates that the debt.

Choose cards with “freeze” or “pause” features when you’re looking for credit cards, choose one that has a “freeze” or “pause” feature included in their mobile app or online. Request a copy of the original credit card agreement that you signed. If a customer won’t accept a.

Eliminating or lowering debt payments could provide. Guard your wallet or purse. 7 hours agomerchants paid about $138 billion in processing fees last year, according to the nilson report, a publication covering the payment industry.

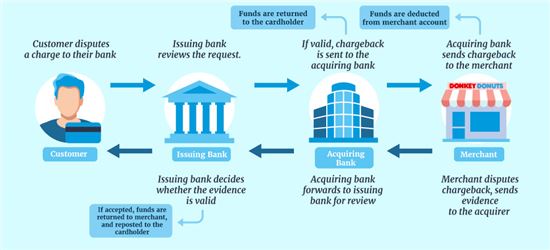

Match ip address and credit card address. How to fight credit card companies suing you. If you double check the ip address and the credit card address to.

One of the big ways that credit card issuers make. The suing party (plaintiff) should be the credit card company or place where you have a bank account (or a company that has purchased outstanding debt that originally. But it’s only the beginning.

A debt consolidation loan combines all of a borrowers’ credit. Hire and attorney to defend you. Request proof that the debt was assigned, i.e.